What is a Good Debt to Income Ratio?

Whether you’re applying for a business credit card, looking to purchase real estate, or refinancing existing business debt, minimizing your debt to income ratio, or DTI ratio, will help any potential business borrower prove their creditworthiness. But what is a good debt to income ratio? Is there an ideal number?

Get Funded Now

What is a Debt to Income Ratio?

Every entity with debt and income has a DTI ratio. You have one, the coffee shop on your corner has one, and the people drinking coffee in that café have them, and even the biggest multinational coffee corporation has one. A DTI ratio very simply puts a numerical value to the difference between how much you’re spending on monthly debt payments and how much money you’re bringing in. That value can help you understand your capacity to take on additional debt.

For a very basic example, a company might have any number of debts: an equipment loan that was necessary to get started, a monthly mortgage payment on a retail space, business credit card debt, a car loan, and more. Let’s say a company spends $2,000 combined on all of the above payments, and that same individual takes home $6,000 per month. Individuals also have DTI ratios, which will include student loan payments, personal loans, child support, alimony, car payments, and any other ongoing debts.

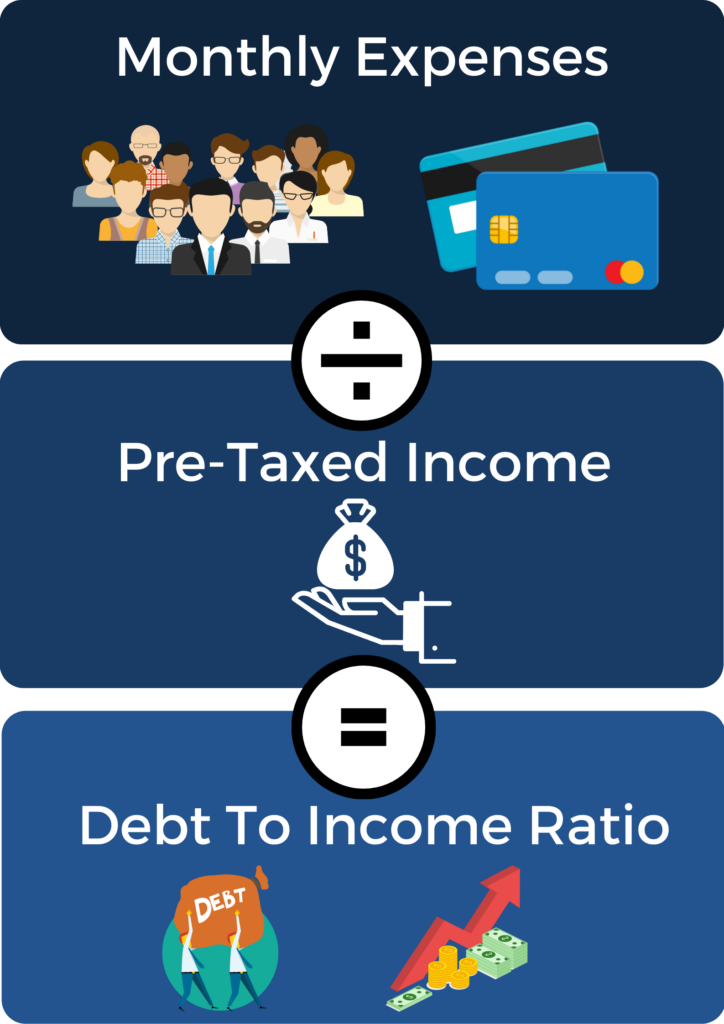

To calculate DTI ratio, you’ll divide your total monthly debt payments by your gross monthly income. For the individual above, that’d be 2,000 divided by 6,000, or .33. Their DTI ratio is 33%, since the debt to income ratio is commonly displayed as a percentage.

Though such a division is more commonly used by mortgage lenders, there are some lenders who will opt not to include housing or real estate payments when calculating your total debt. When that happens, debt-to-income ratios are divided into front-end ratios and back-end ratios. A front-end debt to income ratio includes things like mortgage payments, rent, homeowners insurance, and other housing expenses. A back-end debt-to-income ratio excludes those housing costs, meaning that only credit card payments, auto loans, and other non-housing debts are included in the calculation.

Debt to Income Calculator

iCapital Funding

3000 Marcus Ave

New Hyde Park, NY 11042

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Example Debt to Income Ratio Calculations

Example 1: Company 1 makes $14,000 per month and spends $6,200 per month making minimum payments on existing debts. Company 1 has a DTI ratio of 6,200 divided by 14,000, or 44%.

Example 2: Company 2 makes $8,000 per month and spends $2,000 per month making minimum payments on existing debts. Company 2 has a DTI ratio of 2,000 divided by 8,000, or 25%.

Example 3: Company 3 makes $11,000 per month and spends $7,000 per month making minimum payments on existing debts. Company 3 has a DTI ratio of 7,000 divided by 11,000, or 63.6%.

As you can see here, DTI ratio is independent of income. Company 3 makes nearly 50% more money every month than Company 2, but Company 2 has a DTI ratio indicating that they’re in a prime position to take on additional debt. Even if Company 3 has an immaculate credit history and if Company 2 had poor credit, the latter is still going to be better able to make payments.

Why do Debt to Income Ratios Matter?

It’s true that credit agencies do not take income into account while calculating your business’s credit score, so having a tiny DTI ratio won’t show up on your credit report in and of itself. But that doesn’t mean that it isn’t important.

Because DTI ratios measure your monthly gross income against your total amount of debt, they’re a very simple and easy-to-understand way of determining where your company stands in terms of handling total debt. If your DTI ratio is too high, you may want to consider making a concerted effort to drop it down (more on this later).

In addition to helping you understand how your company stands at the current moment, debt to income ratios can help you evaluate your company’s ability to take on additional debt obligations. Many financial firms consider a debt to income ratio under 36% to be most ideal, and a DTI ratio over 50% to be the “danger zone” where debt becomes overly burdensome. So when you’re considering whether to seek out additional loans, have a look at your company’s DTI ratio and particularly what that ratio would be if you’re approved for a loan.

A low DTI ratio doesn’t necessarily mean you should seek out additional financing. There are all the usual factors to consider when you’re thinking about additional debt, including your overall financial health and the purpose of that additional funding. But a low DTI ratio does generally indicate that your company is having no problem paying its monthly bills, and can probably afford to add to those payments.

How Can I Improve my Company’s Debt to Income Ratio?

There are several strategies for improving debt to income ratio, but they all boil down to basic math: to make your DTI ratio smaller, you’ll need to either make the numerator (debt) smaller, the denominator (income) bigger, or both.

1. Increase revenue

The simplest way to improve your DTI ratio is to increase gross income without increasing debt obligations. Consider whether you can improve your products or services, whether you can increase prices, expand into new markets, or pivot away from a less profitable sector of your business into a more lucrative arm. In addition, if you’re selling a product of some kind, you could attempt to reduce wholesale costs to increase profit margins without changing existing pricing.

2. Reduce debt payments

How can you reduce debt payments? There are a few options that could be particularly helpful.

Firstly, you can do your best to pay off smaller loans faster. This is sometimes known as the snowball method, in which debts are paid off from smallest to largest in order to create momentum. Paying more on your smaller debts might create higher DTI ratios in the short term, reducing overall debt will lower DTI ratios in the long term, leading to greater opportunity for additional funding.

By attacking smaller debts, you’ll also be improving your company’s credit utilization ratio. Unlike DTI ratio, this ratio does appear on your credit history. A credit utilization ratio measures the percentage of borrowed money against your total available credit. If you’ve got a $10,000 line of credit and you’ve used $8,000 of it, you’ve got a credit utilization ratio of 80%. That’s very high. By attacking small debts, you’re improving your credit utilization on top of improving your DTI ratio, and those two improvements in concert can improve your eligibility for additional lending.

Secondly, you should consider debt refinancing. If your credit history shows that you’re a more qualified borrower than you were when a loan was initially financed, refinancing that debt could lead to lower interest rates, and thus smaller payments.

You could also look into debt consolidation. Instead of making single payments on multiple debts, consolidation allows you to make one larger payment on multiple debts at once. Again, if you’re highly creditworthy, refinancing at the time of consolidation can make payments smaller, improving your DTI ratio.

Finally, some debts may be eligible for longer repayment terms. By stretching a loan out over a longer time period, you may be able to reduce payments (even though total interest payments may increase.

3. Find hidden costs

Finding hidden costs within your company could be a helpful way to attack a high DTI. Every company has money being spent on unnecessary purposes. Are you spending a ton of money on a service that you could take on for yourself, like tax filing or basic accounting? Are your wages in line with the industry? Are you purchasing inventory appropriately?

At some point, your company will need a new loan.

Improving your debt to income ratio by boosting revenue, decreasing debt, or both will lead to your company being in a better position to take on additional loans or lines of credit. Loan providers want to see that your company is in a prime position to be able to make payments for the foreseeable future, and improving your DTI ratio is a fantastic way to get your financial house in order and ready to make those payments.